Index

platform. Access Here

platform. Access Here

This indicator is also available on the cTrader

platform. Access Here

platform. Access Here

Prequisites

To use this indicator you should have available the following prequisites

- NinjaTrader 8. Click here to download

- Order Flow data is not required to use this indicator (you don't need to have a Lifetime license)

- automated-trading.ch Account with Premium Subscription

We highly recommend joining our discord community by following this invite link

![]()

Description

The NinjaTrader 8 Swing Breakout Sequence indicator is inspired from Stoic Trader's trading model presented by Stoic himself here : Link to youtube video

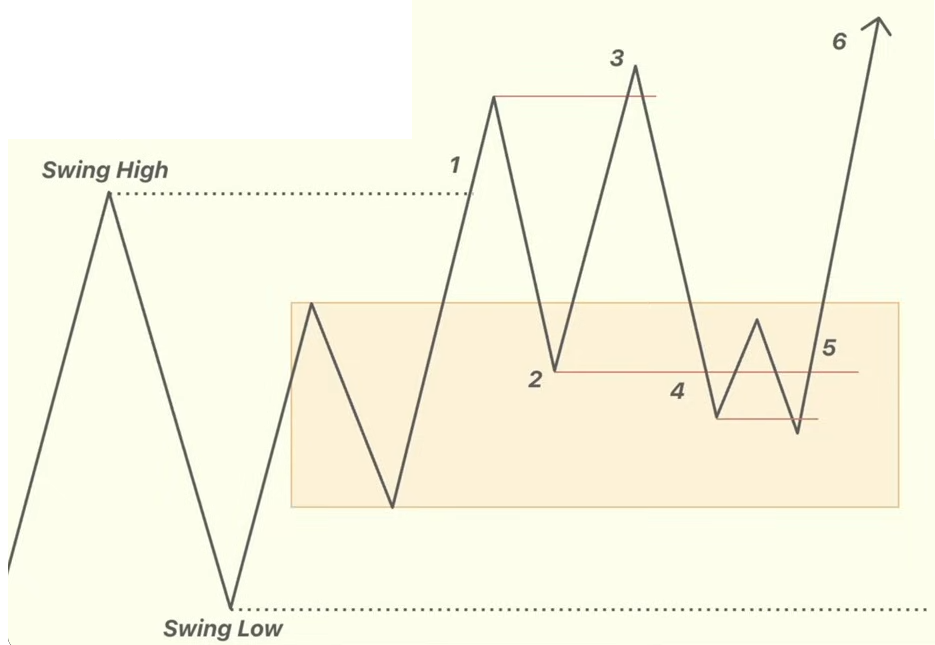

This indicator implements a high probability entry model with a defined risk reward ratio. This entry model is based on a sequence of 5 swing sequence as illustrated on the image below

The image above represents the long model entry, for the short model entry, it is the inverse of this as we will see later

Examples

Here are few examples of how the indicator works:

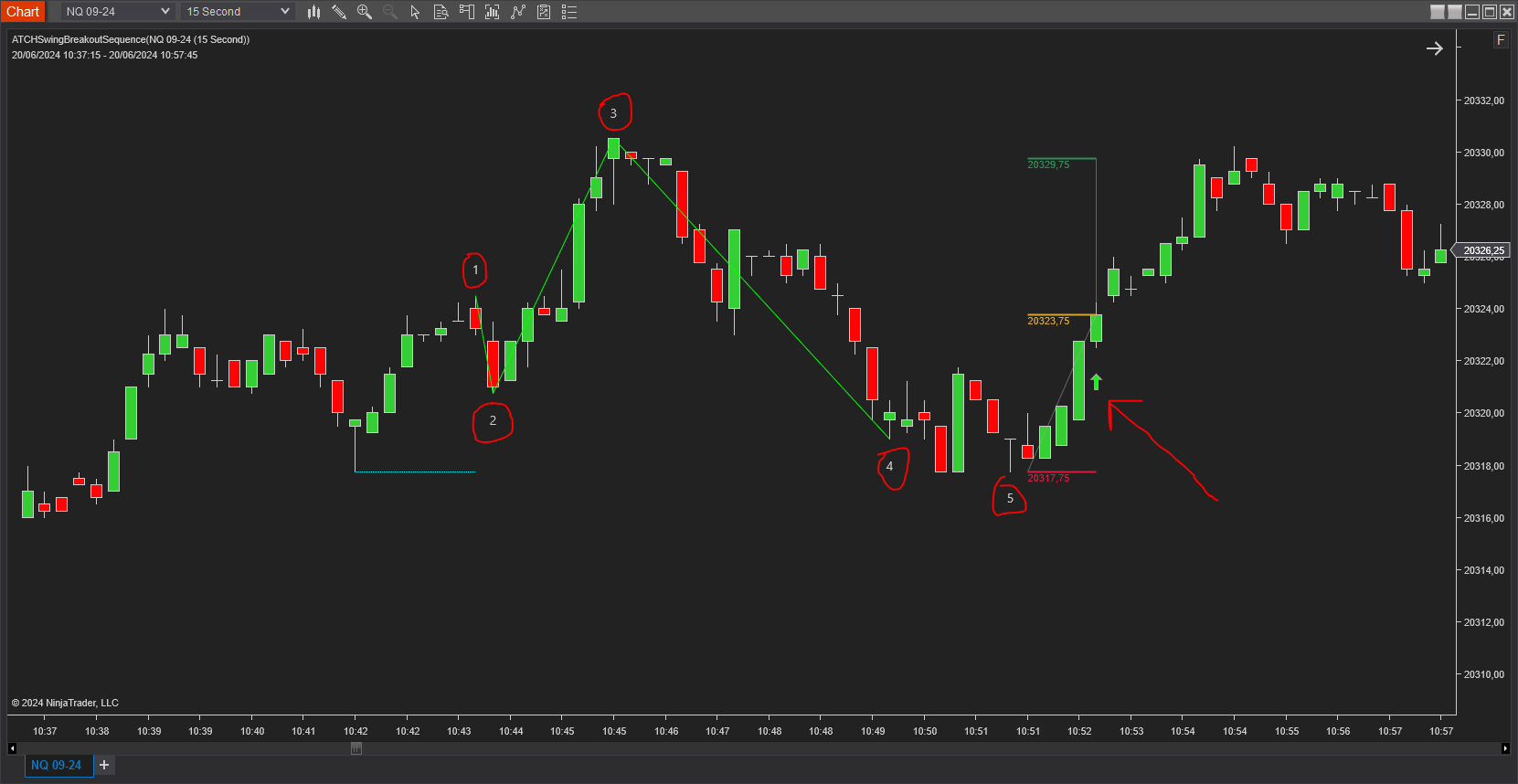

On the below examples, you can see some instances of entry signals both long and short detected on the NQ instrument on the 15 seconds timeframe

On this first example you can see a long Swing Breakout Sequence ending with a confirmed long entry signal with a 1:1 win-loss ratio

You can aslo see on the left on the beginning of the sequence the potential stop loss level drawn in the color Cyan with a dashed line

This second example illustrates a short entry sequence with a confirmed entry signal drawing a 1:1 winloss ratio

When the market is volatile and chunky the indicator can detect multiple interfering sequences and some of those are losing trades, as shown on the image above

Features

The Swing Breakout Sequence indicator has a set of unique features

- Plots Swing Breakout Sequence of all timeframes

- Highly customizable, lightweight and can be adapted to wide range of instruments

- Can be integrated into Ninjatrader Strategy Builder or Bloodhound Software

Parameters

We always try to keep the parameters to minimum.

| License | |

| License | This is the license key you get when you create an account on automated-trading.ch. After creating an account, copy your license key from the billing page. You need to set this parameter only once per month, once the license key is validated it will be remembered for the rest of the month. |

| Market Structure | |

| Swing Period | Swings are higher lows,higher highs, lower highs and lower lows. After each price bar close, a swing can be detected. But just after that, the next bar can cancel the swing at the previous bar by creating a new swing of the same type. Or this can happen on the second bar, or the third, etc... The swing period sets how many bars is enough to seperate two swings of the same type. The more you increase this parameter, the more you decrease the number of swings overall. The more you decrease this parameter, the more you increase the number of overall swings. I personally use the value of 3 or 4 for this parameter. |

| Breakout Swing |

|

| Breakout Fibo Level | This parameter is only used if the Breakout Swing is selected as Fibonacci Retracement

|

| Quality Filter |

This parameter will allow you to set a filter on the quality of detected SBS based on certain criteria

|

| Invalidation Method |

|

| Min SBS Bars Count | This parameter can be used as a filter to set the minimum number of bars that composes the SBS structure. This can be useful to filter out small SBS structures that don't occupy a sufficient number of bars and are insignificants |

| Max SBS Bars Count | This parameter can be used to filter out SBS structures that are too big in numbe of bars. In general, SBS strucutres that span on a very big number of bars don't generate profitable signals |

| Max Bars Between Swings | This parameter can be used to filter out SBS structures that are very wide swing points. The filter will remove SBS structures that have high number of bars between their swing points |

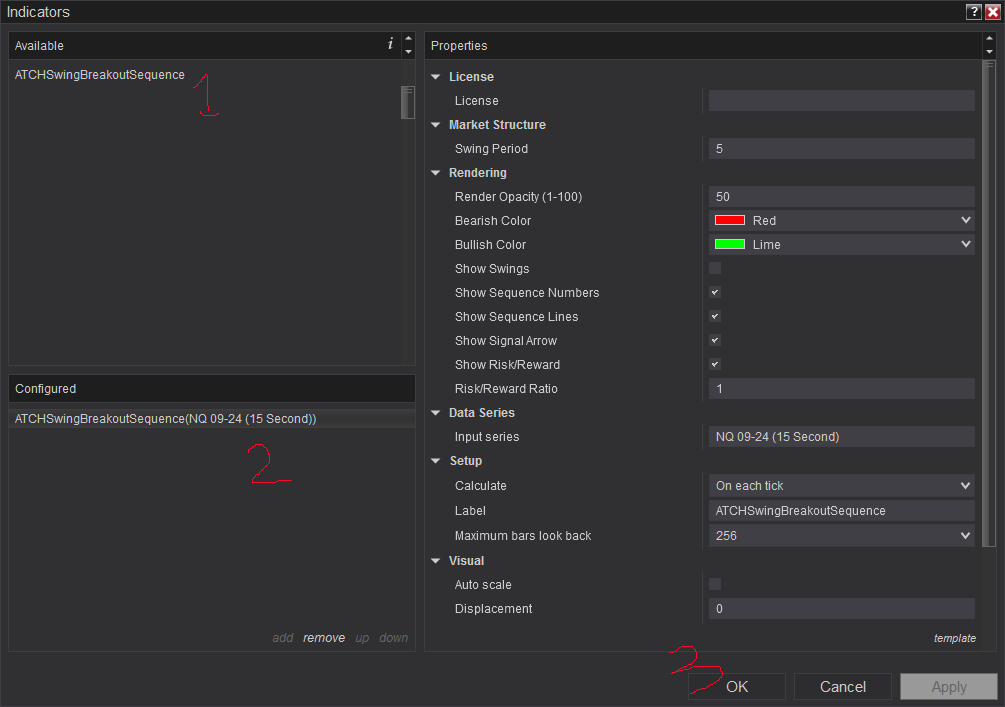

| Rendering | |

| Render Opacity (1-100) | The opacity to render objects on the chart. I personally prefer the value of 20 for this parameter |

| Prior Level Bearish Color | Draw Color of bearish prior level to draw on the chart |

| Prior Level Bullish Color | Draw Color of bullish prior level to draw on the chart |

| Show SBS Prior Swing Levels | Enable/Disable drawing of prior higher highs and lower lows of each swing sequence. The color of those levels is fixed to Gold |

| Bearish Color | Draw Color of bearish items to draw on the chart |

| Bullish Color | Draw Color of bullish items to draw on the chart |

| Show Price Swings | Enable/Disable drawing of Swing points on the chart |

| Show Sequence Numbers | Enable/Disable drawing of numbers labels below/above each swing sequence point |

| Show Sequence Lines | Enable/Disable drawing of lines connecting the swing sequence points |

| Show Signal Arrow | Enable/Disable drawing of the arrow on each valid swing sequence breakout |

| Show Risk/Reward | Enable/Disable drawing of the risk reward tool on each valid swing sequence breakout |

| Risk/Reward Ratio | When drawing of risk/reward is enabled, the parameter sets the risk reward ratio value |

| General | |

| Play Sound | This parameter will enable playing and alert sound when a swing sequence is detected |

| Play Sound File | This parameter will set the file name to be played on sound alert. This can be set to any .wav file on your computer |

Download & Installation Instructions

To download and install the indicator follow the instructions below

- Click on the below download button to download the Indicator file

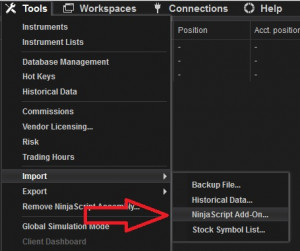

- Import the downloaded .zip file into NinjaTrader using the import NinjaScript menu item

- Next, open a new chart window

- After installing the indicator and opening a new Chart window you should add the indicator to the chart. Right-click on the chart and click on Indicators...

- Copy/Paste your license key that you can find on the Billing page into the license parameter

- After adding the indicator to the chart, the indiactor will be run on Historical data loaded in the chart.

- After that, the indicator is added with success and will continue to run on live market data

- The indicator has two output Plot series that can be used in Strategy Builder or Bloodhound. The first Series if for Buy signals, and the second series is for Sell signals.

Frequantly Asked Questions

General

Yes, If you have an idea that you believe can improve this indicator, I will be more then happy to hear from you. Please use the contact page to send me a message

No, the source code of the indicator is protected for copyright reasons

No, this indicator only do rendering and doesn't provide data that can be used from within a strategy.

Yes you can use this indicator without TickReplay

Release Notes

- Exposing parameters to be used inside Ninjatrader Strategy Builder

- Bug Fix: Bloodhound and Algo Studio Pro integrations

- Added new breakout method : Immediate Swing 4

- Added new filter : Max bars between swings

- The indicator became Premium requiring a subscription

- Adding Buy signals plot and Sell signals plot enabling usage in Strategy builder and Bloodhound

- Drawing of SBS sequence numbers is pixel based. This fixes the issue with numbers drawn far away on instruments like CL (oil)

- Added new parameters : Invalidation Method, Min SBS Bars Count, Max SBS Bars Count

- SBS sequences started on invalidated price swing are removed, this allow respecting the swing period

- Added Brush selection for prior swing levels

- Stop Loss calculation updated to include Prior Swing, Swing4 and Swing5

- Removed strong condition on Swing5 price. Before this update, Swing5 required to be below/above Swing4. This condition was removed which now means that Swing4 and Swing5 are only required to be successive Swing Lows (for bullish) or Swing Highs (for bearish) regardless of whether Swing5 is higher or lower than Swing4

- Added Quality Filter option

- Detection Rule less strict for more pattern detection

- Added Fibonacci Retracement Breakout method

- Bug Fixed Prior Swing Logic

- Fixed Null reference exception

- Added Swing Breakout option parameter

- Fixed init error with Swing Period param

- Improving speed by resetting search on new day

- Added Play sound option

- First Release of the indicator

User Comments & Feedback

You can find feedback of our users and ask questions about this strategy by joining our discord community by following this invite link or clicking on the Discord logo image. Joining is completely free

![]()