Prequisites

To use this indicator you should have available the following prequisites

- Quantower trading platform v1.141.19. Click to Download the platform

- Free Quantower License. Click Here to get one

- automated-trading.ch Account with Premium Subscription

We highly recommend joining our discord community by following this invite link

![]()

Description

The Quantower Swing Breakout Sequence indicator is inspired from Stoic Trader's trading model presented by Stoic himself here : Link to youtube video

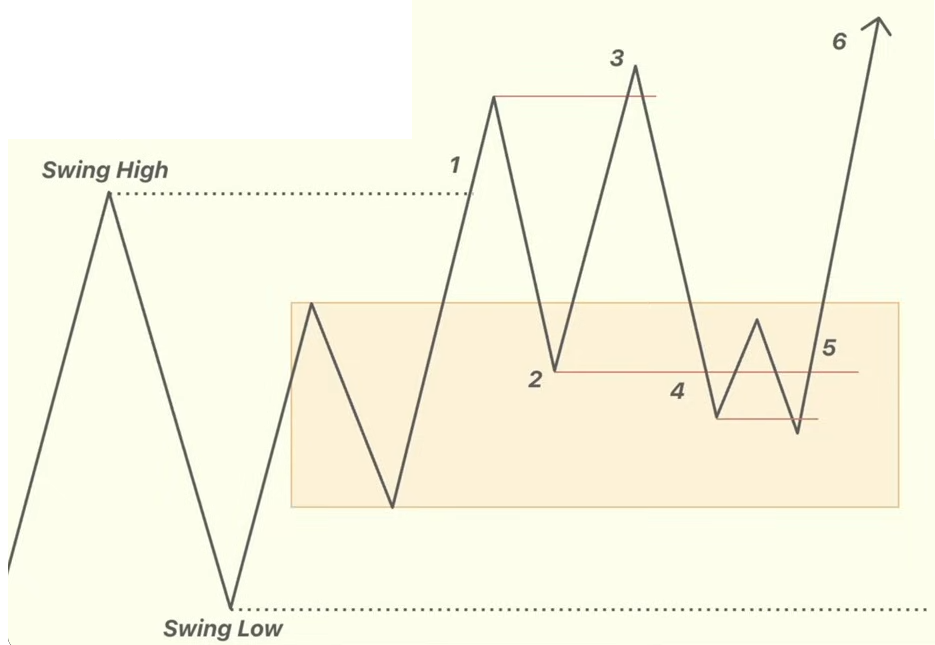

This indicator implements a high probability entry model with a defined risk reward ratio. This entry model is based on a sequence of 5 swing sequence as illustrated on the image below

The image above represents the long model entry, for the short model entry, it is the inverse of this as we will see later

Examples

Here are few examples of how the indicator works:

On the below examples, you can see some instances of entry signals both long and short detected on the NQ instrument on the 15 seconds timeframe

On this first example you can observe a bullish Swing Breakout Sequence on the NQ instrument. The sequence was triggered when the Swing 3 was broken at the bar marked with a red arrow.

You can also see the dashed line linking the breakout bar and the Swing3 price which marks the breakout level

On real-time mode, the sequence is only drawn when the breakout occurs. When the breakout is triggered the whole SBS pattern will be drawn along with a Sound Alert if you chose to activate the play sound parameter.

This second example illustrates a bullish pattern that was detected with the same parameters as the previous one but this SBS pattern was not a succes as the price immediately pulled back into the other direction.

Not all SBS sequences will be profitable. The SBS pattern is not perfect. The Quality Filter will filter out bas SBS instances, but there will be always bad ones that will be detected

This third example illustrates two successfull bullish then bearish examples of two SBS patterns on the 1-minute NQ chart. The strategy here would be to open a trade when the breakout is triggered. Set the stoploss either on the Swing4 or Swing5 prices, and 1:1 profit to loss ratio

Features

The Swing Breakout Sequence indicator has a set of unique features

- Plots Swing Breakout Sequence on any timeframe

- Sound Alerts

- Highly customizable, lightweight and can be adapted to wide range of instruments

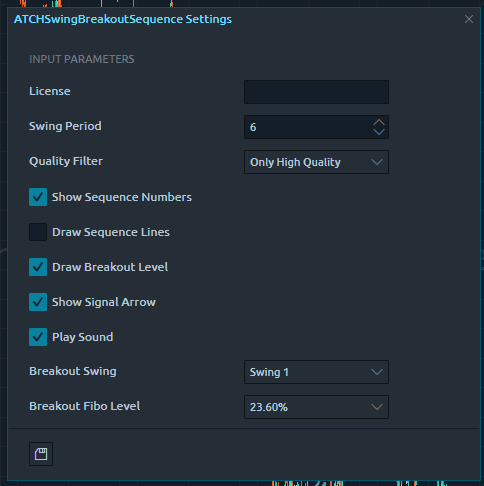

Parameters

We always try to keep the parameters to minimum.

| License | |

| License | This is the license key you get when you create an account on automated-trading.ch. After creating an account, copy your license key from the billing page. You need to set this parameter only once, once the license key is validated it will be remembered. |

| Swing Period | Swings are higher lows,higher highs, lower highs and lower lows. After each price bar close, a swing can be detected. But just after that, the next bar can cancel the swing at the previous bar by creating a new swing of the same type. Or this can happen on the second bar, or the third, etc... The swing period sets how many bars is enough to seperate two swings of the same type. The more you increase this parameter, the more you decrease the number of swings overall. The more you decrease this parameter, the more you increase the number of overall swings. I personally use the value of 3 or 4 for this parameter. |

| Quality Filter |

This parameter will allow you to set a filter on the quality of detected SBS based on certain criteria

|

| Show Sequence Numbers | Enable/Disable drawing of numbers labels below/above each swing sequence point |

| Show Sequence Lines | Enable/Disable drawing of lines connecting the swing sequence points |

| Draw Breakout Level | Enable/Disable drawing of a line between the breakout swing and the current bar that triggered breaking that swing level. |

| Show Signal Arrow | Enable/Disable drawing of the arrow on each valid swing sequence breakout |

| Play Sound | This parameter will enable playing and alert sound when a swing sequence is detected |

| Breakout Swing |

|

| Breakout Fibo Level | This parameter is only used if the Breakout Swing is selected as Fibonacci Retracement

|

| Rendering | |

| Bullish Brush | Draw Color of bullish items to draw on the chart |

| Bearish Brush | Draw Color of bearish items to draw on the chart |

Download & Installation Instructions

To download and install the indicator follow the instructions below

- Click on the below download button to download the Indicator file

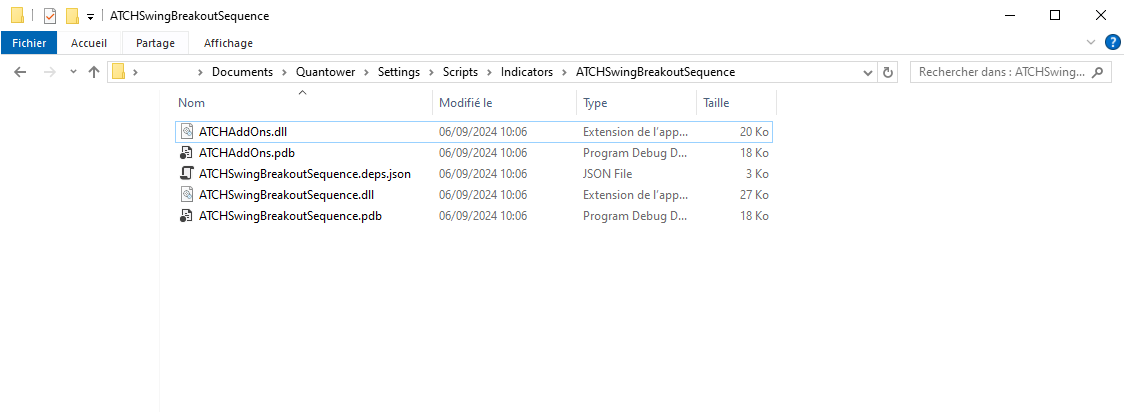

- As illustrated on the image below, extract the whole content of the zip file into your Quantower indicators folder. The indicators folder can be found by default following this path : {C:\Users\{Windows Username}\Documents}\Quantower\Settings\Scripts\Indicators

- Make sure the files are extracted inside a new folder called ATCHSwingBreakoutSequence

- Next, open a new chart window

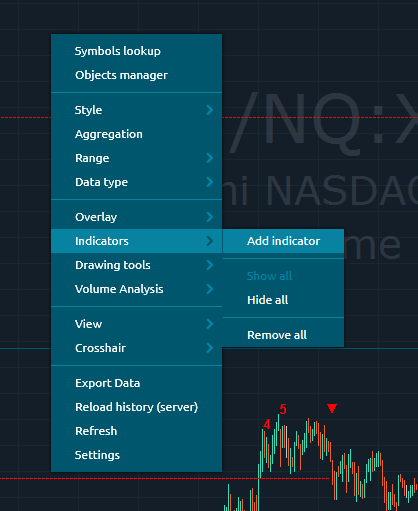

- After copying the indicator files and opening a new Chart window you should be able to add the indicator to the chart. Right-click on the chart and click on Indicators -> Add Indicator

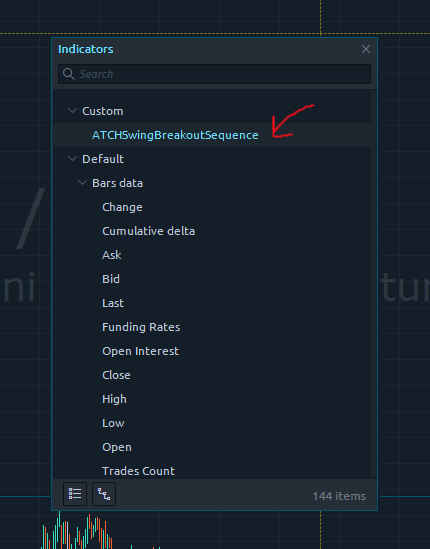

- Then select the Custom/ATCHSwingBreakoutSequence entry from the indicators list and Double-Click on it

- After that, you will be able to set the parameters of the indicator in the next panel. At this stage, the indicator should be already added to the chart

- At this stage, you should copy/paste your license number into the License parameter, you can find your license number Here

- If your License was not successfully recognized. You will see an error message on the Chart.

- After adding the indicator to the chart and succesfully submitting your License number, the indicator will be run on Historical data for a couple of seconds

- After this step, the indicator is added with success and will continue to run on live market data

Frequently Asked Questions

General

Yes, If you have an idea that you believe can improve this indicator, I will be more then happy to hear from you. Please use the contact page to send me a message

No, the source code of the indicator is protected for copyright reasons

No, this indicator only do rendering and doesn't provide data that can be used from within a strategy.

Subscriptions Q&A

Yes, you can Cancel/Resume your subscription with a click of a button with no questions asked. You don't even need to request something or send a message. You can manage your subscription in a completely autonomous way.

Our products will verify the license validity at 1st day of each month. At that date, you need to provide the license number to the product (with a simple copy/paste) so that it will be valid to the rest of the month.

We do not store payment credentials, they are encrypted and passed to Stripe or PayPal for a safe & secure way to purchase subscriptions on our site.

Please send us a message from the Contact Page

Release Notes

- Updated the indicator for Quantower v1.141.19

- Fixed bad drawing of numbers and arrows on lower timeframes

- Removed strong condition on Swing5 price. Before this update, Swing5 required to be below/above Swing4. This condition was removed which now means that Swing4 and Swing5 are only required to be successive Swing Lows (for bullish) or Swing Highs (for bearish) regardless of whether Swing5 is higher or lower than Swing4

- First Release of the indicator

User Comments & Feedback

You can find feedback of our users and ask questions about this strategy by joining our discord community by following this invite link or clicking on the Discord logo image. Joining is completely free

![]()